california sales tax payment plan

If you cant pay your tax bill in 90 days and want to get on a payment plan you can apply for an installment agreement. Pay a 34 setup fee that will be added to my balance due.

21 Billion Budget Surplus More Than 2 Billion In New Taxes

An application fee of 34 will be.

. Change or cancel a payment plan. You will receive an acceptance letter within 90 days. A payment plan will cost 34 to set up added to your balance.

Box 2952 Sacramento CA 95812-2952. As an individual youll need to. Effective December 15 2020 small business taxpayers with less than 5 million in taxable annual sales can take advantage of a 12-month interest-free payment plan for up to 50000 of sales.

Make monthly payments until my tax bill is paid in full. Special Taxes. You may be required to pay electronically.

By completing Form FTB 3567 and sending it to the State of California Franchise Tax Board PO. Pay by automatic withdrawal from my bank account. Individual taxpayers and businesses can apply for instalment plan agreements from the FTB.

It may take up to 60 days to process your request. BREAKING NEWS Effective April 2 2020 California is granting small businesses 12 months to gradually remit the sales taxes that they have collected from customers. Pay including payment options collections withholding and if you cant pay.

To be eligible the amount owed must be less than 25000. For the approximate 995 of business taxpayers. Common reasons to change or cancel.

Individual taxpayers need to pay a 34 setup fee that is added to their balance when setting up a payment plan. Providing a three-month extension for a tax return or payment to any businesses filing a return for less than 1 million in tax. The state typically gives a taxpayer three to five years to pay off a balance once a California state income tax payment plan has been granted.

To change your current installment agreement call us at 800 689-4776. Pay including payment options collections withholding and if you cant pay. California Announces Sales Tax Payment Plan for Small Businesses due to COVID-19.

Meanwhile businesses are required to pay off whats owed. For sales and use tax originally due between December 15 2020 and April 30 2021 business taxpayers with less than 5 million in annual taxable sales are eligible for a 12. Simplified income payroll sales and use tax information for you and your business.

State sales and use taxes provide revenue to the states General Fund to cities and counties through specific state fund. Processing the application takes 90 days and costs 34 for individuals and 50 for businesses. You may be required to pay electronically.

A sellers permit is issued to business owners and allows. You can request a payment plan and pay down your. Keep enough money in.

You can register online for most sales and use tax accounts and special tax and fee programs. Effective April 2 2020 small businesses with less than 5 million in taxable annual sales. Most retailers even occasional sellers of tangible goods are required to register to collect sales or use tax in California.

Sales. Change your payment amount or. The state tax rate the local tax rate and any district tax rate that may be in effect.

Under the Payments section select Request a Payment Plan to begin your request. The sales and use tax rate in a specific California location has three parts.

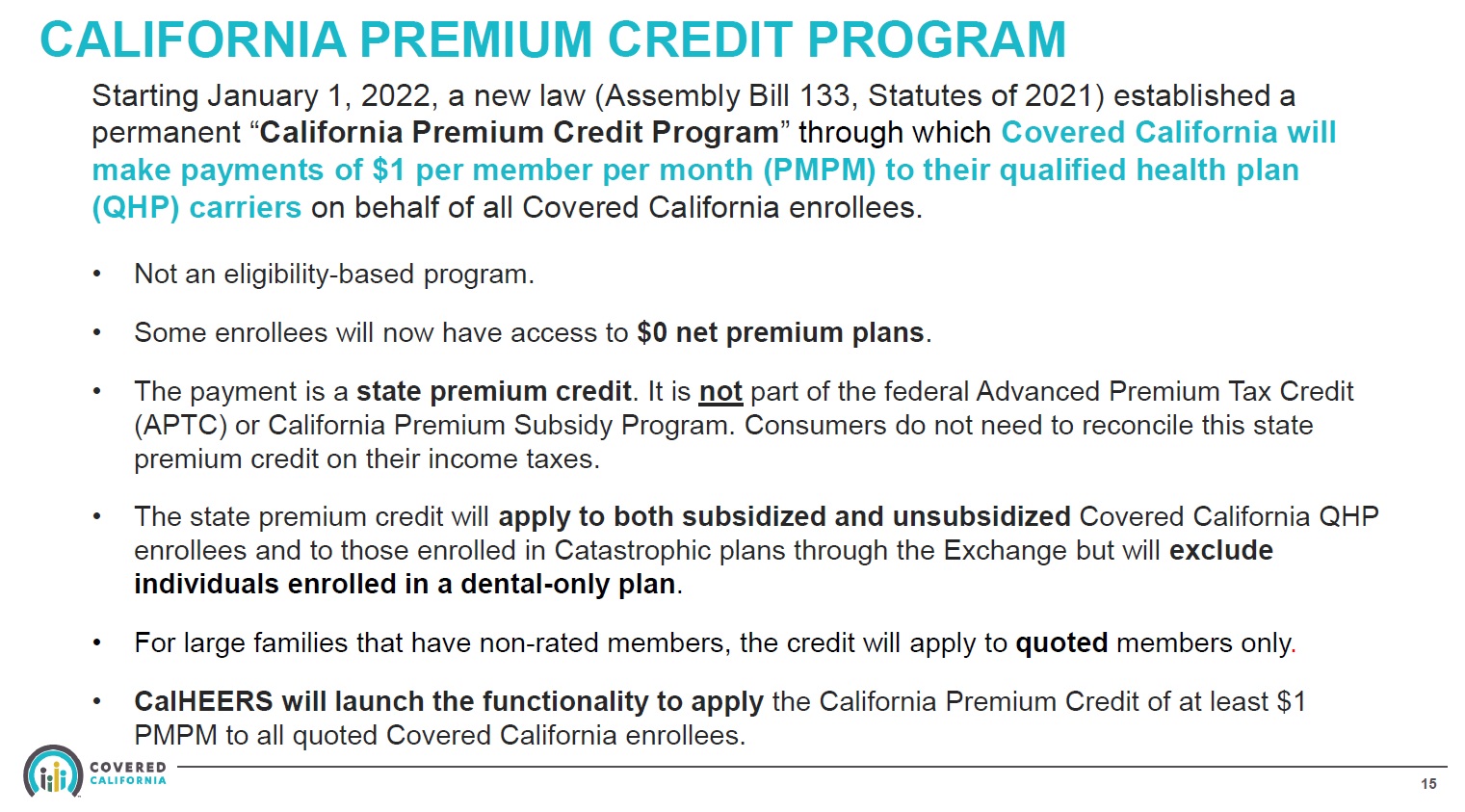

1 Dollar Covered California Member Bonus For 2022

Surplus In Hand California Governor Proposes Tax Cuts Expanded Health Care Cbs8 Com

Cavuto Presses California Assemblyman Over Wealth Tax Plan Amid Millionaire Jailbreak From Golden State Fox Business

California Sees Warning Sign From Weak Tax Revenue Collections Bloomberg

Unaffordable California It Doesn T Have To Be This Way

State Of California Franchise Tax Board We Understand Unexpected Events Can Make It Hard To Pay Your State Income Taxes On Time If You Owe 25 000 Or Less And Can Pay

Stop Stressing About Sales Tax Online And Grow Your Business

California Tax Relief What S In The Deal Calmatters

Free Payment Plan Agreement Template Word Pdf Eforms

:max_bytes(150000):strip_icc()/1040-V-df038816cc244b248641f447493a030d.jpg)

Form 1040 V Payment Voucher Definition

Newsom Offers Too Little Too Late For Small Businesses Orange County Register

How To File And Pay Sales Tax In California Taxvalet

State Accepts Payment Plan In Folsom Ca 20 20 Tax Resolution

California Will Tax Sales By Out Of State Sellers Starting April 1 2019